In my first blog I wrote about joining the stock market as a total beginner, how I performed in my first year and I shared some of my lessons learned. In part 2 I will continue where I left off.

Looking back at my old strategy

I found out that the strategy I was following was not working well. I looked at companies that I liked and I thought would be around for a while, and then bought them. This of course is not a proper strategy or system, because how could I determine if I paid too much? And if I accidentally had a good deal, when would I ever sell? I knew I had to improve on my strategy, otherwise I would just be gambling instead of investing.

Intrinsic value of a stock

It is easiest to explain what the intrinsic value of a stock is, by comparing it to buying a TV. Let’s say a TV is worth a 1,000 dollars (intrinsic value). If someone would offer this TV to me for 100 dollars, I would of course buy it. But if it was offered for 10,000 dollars, I would laugh in the seller’s face. The same principle goes for buying a stock, but the only difference is that it is way more difficult to determine the stock’s intrinsic value (the TVs value of 1,000 dollars).

How to determine the intrinsic value?

If you want to determine the intrinsic value of a stock, you will have to look at the future cash it will generate for you. If the future cash flows are low, the stock is worth less, and when the future cash flows are high, the stock is worth more. There are (at least) two factors that complicate this. You can’t predict the future, and one dollar in the future is worth less than a dollar today.

You can’t predict the future

If we knew the future, we would easily become millionaires with stocks or the lottery. We can’t fully predict the future, but we can try to get close, based on assumptions. These assumptions are about the revenue growth of the company, the profit margin and other factors like debt and cash. I understand these concepts and how they relate, but putting a number to them is what makes calculating the intrinsic value so difficult. A minor change in the revenue growth percentage will influence the intrinsic value of a company a lot. In a future blog I will showcase how I try to calculate the intrinsic value and show why it is so complex. This will also explain how to make sure that a dollar right now is valued higher than a dollar in 5 years.

Intrinsic Value and Stock Price

Understanding the difference between the stock price and the intrinsic value of a company was a real eye-opener for me. Even though the stock price can vary over the short term, in the long run it can only go towards this intrinsic value. This understanding makes me very optimistic about my future steps on the stock market and I’m certain I can gain experience and become better with determining the intrinsic value.

Diversify to spread your risk

In order to make sure you do not put all your eggs in one basket, it is important to diversify your portfolio. You can do this in different ways. A first important step is to not only buy one type of stock, but to make sure you have somewhere between 10 to 20 companies. The different companies that you buy are also very relevant. Which sector are they in? Which currency are they dealing with? Where are they located geographically? Diversification can be done on all these aspects, and is important to mitigate the risk that you lose a lot of money. When for example technology goes down and the majority of your stocks are tech related, then you are in a bad spot. Diversification can prevent this from happening.

The first rule is to not lose money

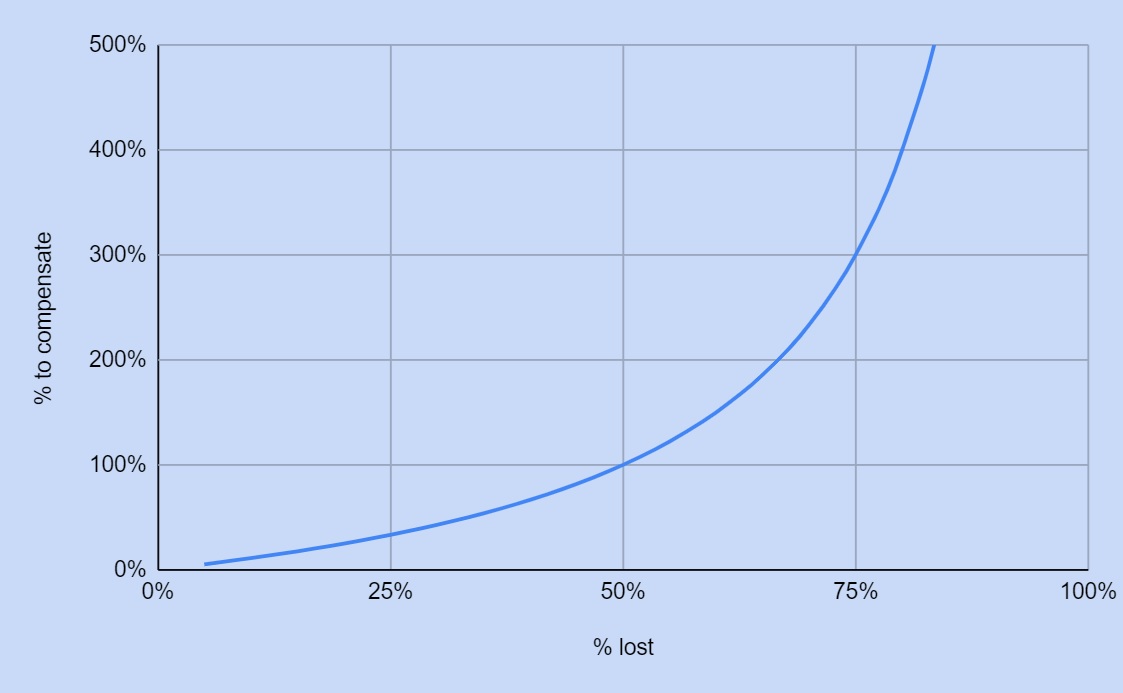

You diversify because you do not want to lose money. Taking a higher risk can lead to a higher reward, but the pros usually do not outweigh the cons. It is important to realize that losing 20%, means you have to make up 25% (20/80) to break even. Losing 50% means you have to make up 100% (50/50), and losing 75% means you have to make up 300% (75/25). Because of this exponential relationship, steady growth is better than high swings.

An easy way to diversify

If you want an easy way to diversify it is a smart thing to buy an ETF, an Exchange Traded Fund. An ETF is a bundle of stocks that are combined into one product. So instead of buying one stock you buy the whole bundle at once. Doing this will automatically make you diversify and spread your risk. There are a lot of different types of ETFs. Some are based on a sector, like technology. Some are based on an ideal, like renewable energy. And some are based on a region. The two most commonly traded ETFs are region based and are the S&P 500 (the SPY) and the MSCI World. The S&P 500 represents the 500 biggest companies publicly traded in the USA, and the MSCI World takes the big companies of 23 developed markets. I personally invest in both of them. I also added the AEX to this list, since I’m from The Netherlands and this ETF follows the Dutch stock exchange.

Summary

So what did I learn during the second half of my first investing year?

- Know the difference between the intrinsic value of a company and the stock price.

- Diversify your portfolio to spread your risk.

- The negative consequences of losing money are far greater than the positive outcome of winning money.

- Use ETFs if you want an easy and accessible way to diversify your portfolio.

Thank you for reading my second blog. I hope it gave you some inspiration. If you have any feedback please let me know. I will be back soon with another blog.

Pingback: Compound Interest - The Secret Weapon of a Long-Term Investor - Tjerk of all Trades

Pingback: How I Entered The Stock Market As A Beginner - Part 1 - Tjerk of all Trades