In my last blog I wrote about preventing losses to make a better return in the long run. This time I will be diving into why time is your biggest ally as an investor. The reason for this is compound interest. The effect of compounding over a long time is a difficult concept to really understand, but once you get it, it will really change your mindset and improve your gains.

What is Compound Interest?

Albert Einstein supposedly said: “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” I am not certain if he actually said it, because Einstein is often misused to give quotes power, but this one might actually be his. I will briefly explain to you what compound interest is. The short version is that compound interest is interest on interest. Let me give you an example. If you have $1,000 and your return in year one is 10%, then you have $1,100. If you make another 10% in year two, then you have $1,210 in total. In the second year you do not only get 10% of your initial investment as a return, but also 10% of the $100 return you had in year one, which is $10. This is your interest on interest, compound interest.

Compounding vs Not Compounding

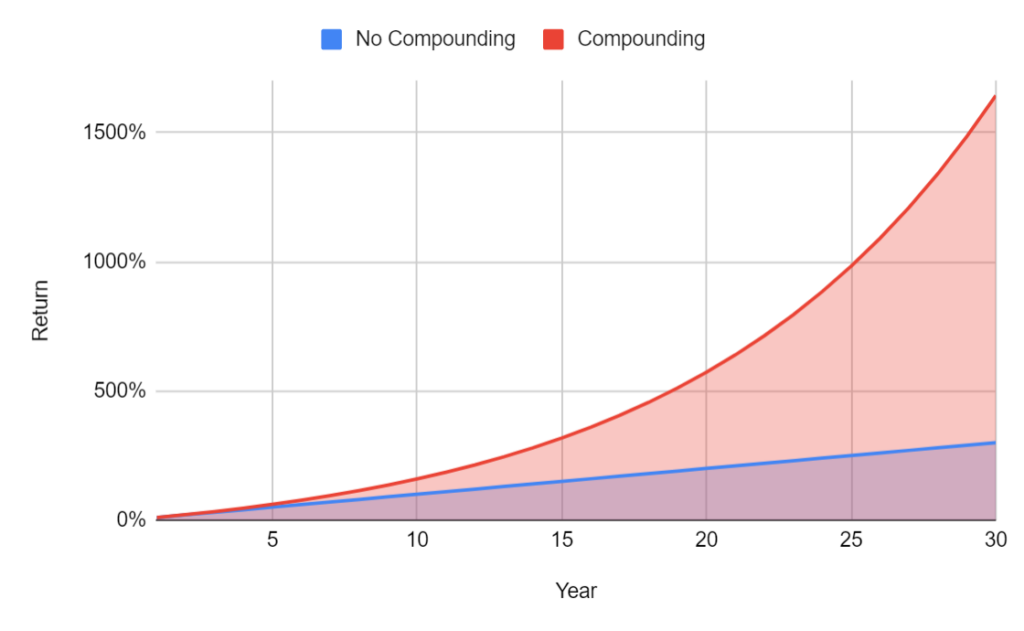

Ok, $10 doesn’t sound like a lot, but let’s continue for 10 years. Without the compounding effect, you would expect about a 10 x 10% = 100% return. But because of the compounding effect this is actually a 159% return! It gets even crazier. Do this for 30 years and your return is 1645% ($16,450), instead of 300% ($3,000). The table and graph below will show you the exponential relationship between time and return if you let your returns compound.

Investing for the Long Run

The exponential power of compounding is really what makes long-term investing so interesting and profitable. The more time you have, the bigger the compounding effect will be and the better your returns will be. Following this logic, it is a very smart thing to start investing as early as possible, even if it is only a little bit. If you invest $100 when you are 18, it will be worth almost $3,000 when you turn 68 when you have a 7% yearly return. This 7% is not a random number, but the average yearly return of the S&P 500, the famous index tracking the 500 biggest publicly traded US-listed companies.

If you want to make your own calculations with compounding returns then this tool can help

The Opposite Effect with Debt

Compounding can also work against you when it comes to debts. If you have a credit card debt with a high interest that compounds often, your debt level can spiral out of control. This goes for your personal finances, but also for companies that have a lot of debt on their balance sheet. Instead of exponentially making money, you are exponentially losing money. One of the many reasons to stay away from high debts.

Conclusion

In conclusion, compound interest is extremely powerful. Let it work for you by starting to invest early. The highest returns occur in the latest years of your investment period. And be careful of debt, this can compound against you.

Thank you for reading until the end. I hope you got something from this. If you have any questions or feedback, please reach out!